01

Strict Investment Criteria

- We focus on opportunities that match our strict investment criteria (size, geography, etc.)

- Once we have identified opportunities of interest we create bespoke action plans in order to unlock value where others cannot

02

Clear Value Creation Plan

- We don’t just provide capital but also significant operational and investment expertise

- Our operating partners dedicate significant time to each investment in order to deliver our common objectives

03

Crystalising Returns

- Our deal teams work closely with each of our portfolio companies over the investment period in order to ensure best-in-class returns for our clients

Our Investment Criteria

Strong Management Team

We want to partner with the best management teams in the market. In all our investments we look for proven operators who are hungry to drive the next phase of growth for the business.

Clear Growth & Scale Opportunities

Companies with clear, identifiable growth opportunities really appeal to us, whether they are participating in a growing market or have an opportunity to capture market share through organic growth and/or add-on acquisitions.

Attractive Industry Dynamics & Market Positioning

We look for companies that operate in fragmented industries, enabling buy-and-build strategies, with meaningful entry barriers and where they command a strong market position relative to competitors.

Solid, Consistent Cash Generation

We typically look for companies that are able to demonstrate a solid record of stable, predictable and growing cash generation.

Clear Opportunity for Trispan Value Add

We don’t just provide capital. We want to help our portfolio companies create value and identify targets where we feel we can leverage our strong Operating Network and experience to unlock value where it could otherwise not be accessed.

Suitable Investment Size

We typically consider opportunities with equity investment <$100M, with our sweet spot around $40-60M, although our funding relationships allow us to invest more if a deal is sufficiently compelling to our investment team.

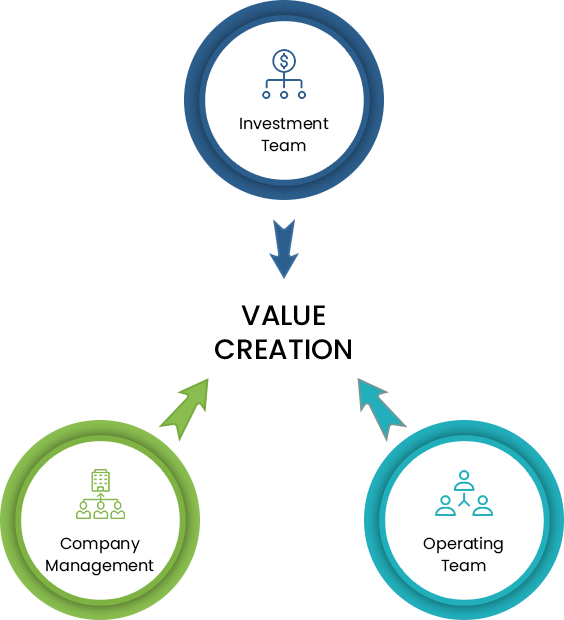

Value Creation

The Trispan platform has been developed specifically in order to enable us to create value and drive returns where others could not

Dedicated Operating Partners

We have a team of dedicated industry veterans who leverage their experience to guide and support company management team’s

Investment Professionals

Our investment team are responsible for sourcing, evaluating & structuring investments that match our investment criteria. They also conduct the monitoring of business performance in order to ensure targets are being met and support portfolio companies in the professionalising of internal systems

Company Management

As part of our diligence we ensure that the management team are highly capable, motivated and ambitious. We also ensure that their values are aligned with our teams in order to foster the future success of all our investments

Crystalising Returns

We offer a flexible investment model that works across various transaction types – full buyouts, partial buyouts, growth capital, etc. That way we work hard to accommodate the interests of all stakeholders. We can often offer opportunities to crystallise returns where other investment firms cannot.

We are able to leverage our extensive international network of advisors, lenders and strategic partners in order to identify the optimal exit opportunity for all our investments.

We partner with the management team in order to implement a set of strategies over the investment horizon that drive growth and transform the business. Once we have sufficiently added value, we will work to ensure all involved benefit from a smooth and appealing exit.